TDS on Purchase & TCS on Sale explained with charts and Tally Entry

TDS on Purchase & TCS on Sale explained with charts and Tally Entry

TDS on Purchase & TCS on Sale explained with charts and Tally Entry

Understanding Compliance:

From Seller Side

| 1 | If Sale Receipts Above 50 lakh | If Buyer is not liable to Deduct TDS u/s 194Q then TCS u/s 206C(1H) @ 0.1 % on Receipts Above 50 lakh |

| If Buyer is liable to Deduct TDS under any other provision of this Act and has deducted such amount then No TCS u/s 206C(1H) | ||

| If Buyer is liable to Deduct TDS under any other provision of this Act and has not deducted such amount then TCS u/s 206C(1H) @ 0.1 % on Receipts Above 50 lakh | ||

| 2 | If Sale Receipts upto 50 lakh | No TCS u/s 206(1H) |

| 1 |

TDS on Purchase & TCS on Sale explained with charts and Tally Entry

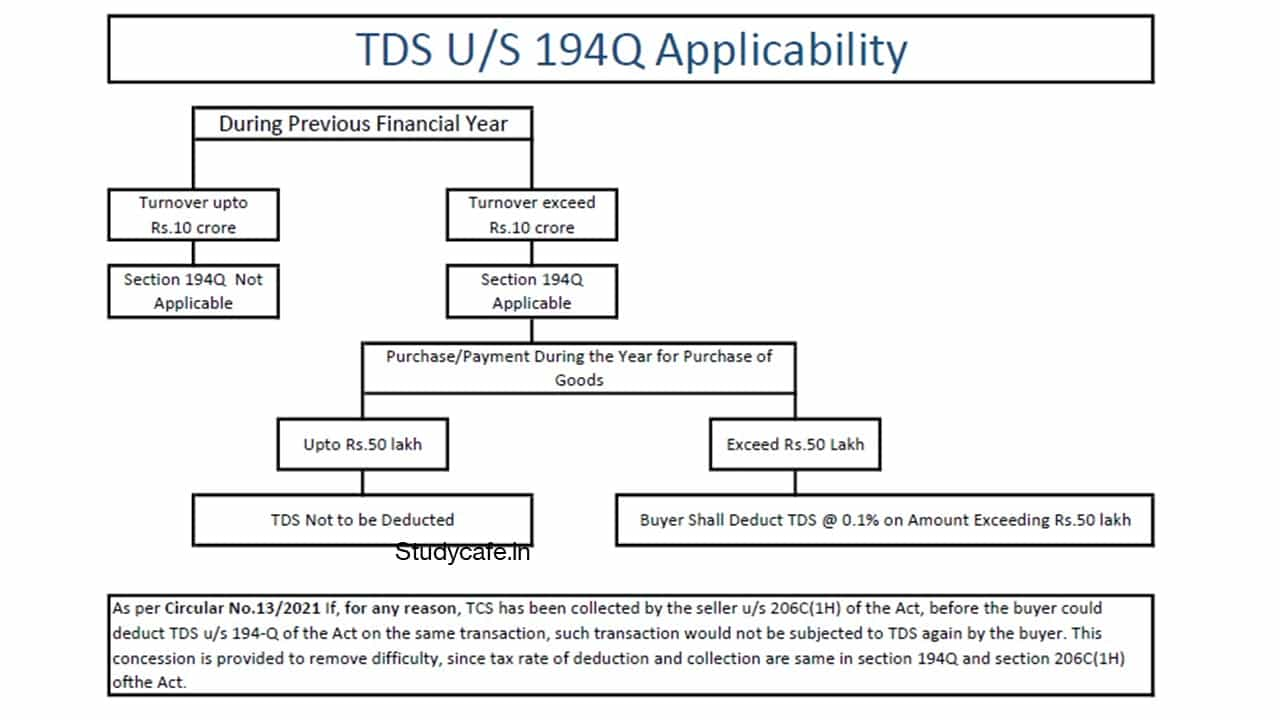

From Buyer Side

| 1 | If Purchase Value Above 50 lakh | Deduction TDS u/s 194Q @ 0.1 % on Value Above 50 lakh |

| 2 | If Purchase Value upto 50 lakh | No TDS u/s 194Q but TCS u/s 206(1H) may be applicable if aggregate payment (Including last year due) exceed 50 lakh during the year |

Let’s Have some Examples

| Seller’s Turnover (Cr) | Buyer’s Turnover (Cr) | Transaction Value (Lakh) | Receipt (Lakh) | Section Applicable | Reason |

| 13.00 | 12.00 | 60.00 | 60.00 | 194Q – TDS | No TCS as TDS applied |

| 8.00 | 12.00 | 60.00 | 60.00 | 194Q – TDS | Buyer’s Turnover Above 10 Cr |

| 13.00 | 7.00 | 60.00 | 60.00 | 206C(1H) – TCS | Seller’s Turnover Above 10 Cr |

| 8.00 | 7.00 | 60.00 | 60.00 | No TDS/TCS | Turnover upto 10 Cr |

| 13.00 | 12.00 | 45.00 | 45.00 | No TDS/TCS | Transaction Value upto 50 Lakh |

| 13.00 | 7.00 | 45.00 | 60.00 | 206C(1H) – TCS | Receipts Above 50 Lakh |

| 8.00 | 12.00 | 45.00 | 60.00 | No TDS | Transaction Value upto 50 Lakh |

| 13.00 | 7.00 | 60.00 | 45.00 | No TCS | Receipts upto 50 Lakh |

Short Summary:

| Particular | SECTION 194Q | SECTION 206C(1H) |

| Tax | TDS | TCS |

| Applicable to | Buyer | Seller |

| Applicable on | Purchase of Goods | Sale of Goods |

| Turnover Limit of Previous F.Y. | 10 Crore | 10 Crore |

| Threshold Limit | 50 Lakh | 50 Lakh |

| Normal Rate | 0.1% | 0.1% |

| Rate Without PAN | 5.0% | 1.0% |

| Time of Deduction/Collection | Payment or Credit whichever is earlier | At the time of Receipt |

| Deposit Date | 7th of Next Month | 7th of Next Month |

| TDS Return Form | Form 26Q | Form 27EQ |

Accounting Entries For TCS u/s 206C(1H) & TDS u/s 194Q

For Seller if he is liable to Collect TCS & Buyer have not Deducted TDS

Accounting Entries For TCS u/s 206C(1H) & TDS u/s 194Q For Seller if he is liable to Collect TCS & Buyer have not Deducted TDS

For Buyer if Seller have Collected TCS (Buyer is not liable to Deduct TDS)

For Seller if Buyer have Deducted TDS (Seller Shall not to Collect TCS)

For Buyer if he is liable to Deduct TDS

*Assumed GST Rate at 5 % / TCS Rate at 0.1 % / TDS Rate at 0.1 % / Threshold Limit of Rs.50 Lakh was crossed *TCS to be Collected on Total Amount including GST *TDS to be Deducted on Amount excluding GST & Purchase Return |

Thanks for sharing about TDS on purchase on sale. Not only does filing an income tax return benefit you, but it also benefits the country. You can also check out about TDS Return For Salary here.

ReplyDelete